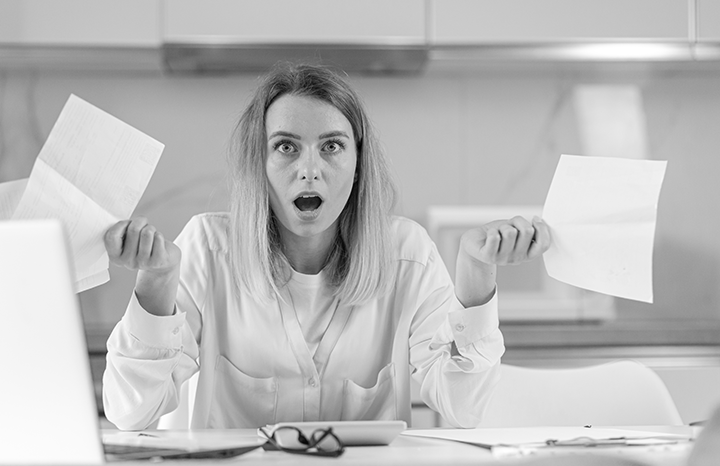

Several hundred euros in additional payments—despite economical heating or prolonged absence during the winter months? This raises the suspicion—often not without reason—that the landlord has not calculated the utility costs correctly. Sometimes there is a strategy behind this, for example when a greedy landlord claims costs “through the back door” that have not actually been incurred or that should be borne by the landlord himself. Often, however, it is simply the landlord's lack of knowledge that leads to incorrect utility bills. This is because there are a number of sources of error that can lead to the bill being (partially) invalid, with the result that the tenant ultimately transfers too much money unnecessarily.

Before conducting an in-depth analysis of the utility bill, the tenant should check whether there is any provision regarding operating costs in the rental agreement. If the lease does not contain any provisions in this regard, the landlord must bear all costs except for heating costs and costs for services commissioned by the tenant, such as electricity and gas (Section 535 (1) sentence 3 BGB, Section 2 HeizkostenV) – in this case, passing these costs on to the tenant is not permitted.

The billing of certain operating costs is also inappropriate if a flat rate for the corresponding costs has been agreed in the rental agreement (Section 560 BGB). In this case, the tenant only owes the agreed flat rate. However, a flat rate can only be agreed for operating costs that are not required by law to be billed on a consumption basis (Section 556a (1) sentence 2 BGB, Sections 2, 4ff. HeizkostenV).

In order to better understand when and for what a supplementary payment would have to be made as a tenant, it is worth looking at the three possible rental structures and classifying your own tenancy accordingly. The most common case is the so-called “net rent” arrangement.

Rental structure

Description

Settlement

The utility bill must be issued in so-called text form (Section 126b BGB), i.e., it can also be sent by email. The law requires that the bill be comprehensible and contain an “orderly compilation of income or expenses” (Section 259 (1) BGB). The tenant must be able to check the compilation of costs and the calculation of the share (so-called transparency requirement).

The following information must be included in a utility bill:

The statement of additional costs must be received by the tenant no later than the end of the twelfth month after the end of the billing period, i.e., regularly no later than December 31 of the following year (Section 556 (3) sentence 2 BGB). In accordance with the principle of uniformity, a billing period must always be considered as a whole, i.e., several bills may not be issued within one year.

If the landlord does not settle the bill by the specified deadline, the landlord can no longer claim any additional payments. The tenant nevertheless has the right to receive a statement of operating costs and to be paid any credit balance. If they do not receive a statement, they can take legal action to obtain one.

The tenant has 30 days from receipt of the statement to respond to any additional claims made by the landlord, i.e. to either pay them or object to them (Section 286 (3) BGB). In addition, the tenant may raise objections within 12 months, even after payment has been made (Section 556 (3) sentence 5 BGB, known as the objection exclusion period). If the tenant then receives an amended statement, this period begins to run again upon receipt, but only with regard to the changes made.

The tenant can also assert a right of retention if they request access to the settlement documents within 30 days (Section 273 (1) BGB in conjunction with Section 556 (4) sentence 1 BGB). The tenant can then retain the additional amount until the review is complete. In the event of a credit balance, the tenant is entitled to have this paid out. The landlord must comply with this claim within 30 days. Alternatively, the tenant can also offset the credit balance against upcoming rent payments (Section 387 et seq. BGB).

The above deadlines for the tenant assume that the bill is formally valid, i.e., that all of the above formalities for the utility bill have been complied with.

Which costs in the operating costs statement can be passed on by the landlord to the tenant—i.e., must be borne by the tenant—depends on whether

Item

distributable yes/no

Errors in the operating cost statement may not only consist of costs being allocated in an impermissible manner, but also in the way in which the costs were allocated. The allocation of costs must be carried out using a so-called allocation key or distribution key. This refers to the standard according to which the individual tenant contributes to the total costs of the whole (example: residential building).

The following allocation keys, among others, can be considered:

As with other tenancy law issues, a distinction must be made between formal errors and material errors in the statement of account.

If, for example, the name of the tenant or tenants is missing or is incorrect (= formal error), the entire statement of account is invalid. This also means that the statutory deadlines for raising objections do not begin to run.

In contrast, the inclusion of a non-allocable cost item does not invalidate the entire operating costs statement, but merely reduces the amount owed by the tenant.

If, as a tenant, you believe that a utility bill is incorrect, for example because the formalities are not correct, utility costs have been incorrectly classified as apportionable, or the amount of the costs suggests a calculation error when compared with previous bills, there are two different options: